Couples who marked Valentine’s Day by getting engaged or moving in together should listen up, as Martin Lewis has some stern advice for you.

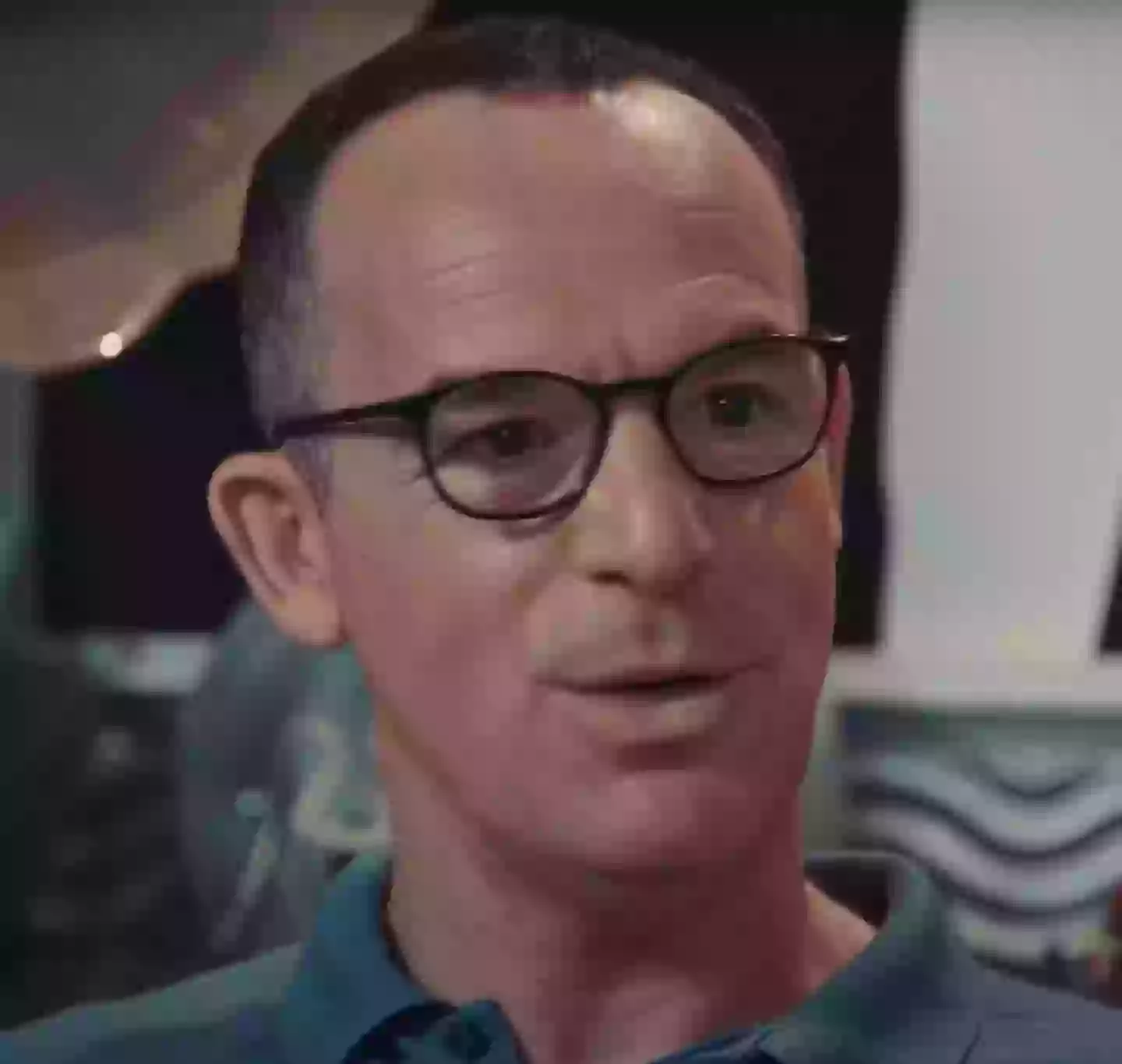

The financial journalist and broadcaster is considered to be somewhat of an oracle when it comes to all things money saving, with the 52-year-old always looking out for ways in which we could be saving or stretching our money.

Whether that’s ways to double your time off work, ‘haggling’ to get the best deals on mobile phone or TV contracts, or even tips on how to beat the family in a game of Monopoly.

Saving the nation money since 1972 (ITV)

When it comes to affairs of the financial kind, whatever Lewis recommends is what we usually do.

And he has a piece of advice which is particularly applicable to those amongst us who are enjoying a romantic Valentine’s weekend. Dishing out the advice on a romantic special of his The Martin Lewis Money Show on Thursday, February 13.

“All the benefits start the day you’re married,” Lewis explained, adding that marriage was ‘absolutely’ worth it in terms of financial benefits.

“None of these apply if you’re just living together,” he continued.

“I don’t care whether you’ve lived together for 20 years, it doesn’t make any difference, I don’t care if you’ve got kids, it doesn’t make any difference. This is about marriage and civil partnerships.”

Lewis also urged couples in a long-term relationship who aren’t interested in the idea of marriage to consider getting a civil partnership as it comes with the same ‘legal and tax benefits’.

“No difference between the two, no difference at all,” he added.

Lewis then went on to explain how marriage is fiscally beneficial from the get-go, revealing that couples could be eligible for a £1,260 marriage or civil partnership tax break (as long as you’re under the age of 90). Couples can also maximise their savings and financial protection should the relationship fail.

More importantly, being married is also critical should one partner pass away, as it allows the surviving spouse more protection.

Which isn’t the most romantic of notions, but it’s certainly something you need to consider.

“When marriage really counts is when you die,” he explained.

The situation becomes even more complicated if an unmarried person dies without a will, as it could leave the surviving partner without access to inheritance or even their home.

There’s more to marriage then just being in love (Getty Stock Images)

“Unmarried couple? That often means diddly squat in law,” Lewis said of the topic back in October.

“Get a will, a contract, a civil partnership or tie the knot. So, you’ve been together decades and have a dozen children – in inheritance law, so what?

He continued: “If you’re not married or don’t have a formal civil partnership, your relationship usually has no status. So if your partner dies, the other one may not get the house. That makes a will even more important here.”

Featured Image Credit: Getty Stock Photo

Topics: Martin Lewis, Money, Valentine’s Day

Martin Lewis has sent a warning to every Netflix subscriber in the United Kingdom after sending out his latest Money Saving Expert (MSE) newsletter.

Martin Lewis has sent a warning to every Netflix subscriber in the United Kingdom after sending out his latest Money Saving Expert (MSE) newsletter.Pushed to subscribers’ inboxes on Wednesday (12 February), the weekly round up from the British financial journalist issued an explainer to those paying for Netflix in the UK, which sits at around 19 million.

And with a reported 8.5 million people signed up to the MSE newsletter, there is likely to be a fair share of crossover in those looking for Lewis’ latest tips while also browsing for the latest bingeable TV show that’s dropped over on Netflix.

Fresh MSE Netflix alert

Prioritising the Netflix alert this week by putting it in the newsletter he edits, Lewis warned subscribers to the streaming platform about ‘hikes’ that have come in to place this time.

Yes, we’re talking about paying more for the same product.

“Netflix hikes prices by up to £24 per year,” Lewis writes in the newsletter before offering tips on how to save.

A Netflix warning from Mr Lewis (Channel 4)

By the time you’re reading this, Netflix has already put its new prices in place with them being effective from last Thursday (6 February) for new customers

Fear not if you’re an exiting customer, though, as the existing 19 million customers have been given a 30 day notice period about when prices will change for you.

The standard plan with adverts is now £5.99 a month, up 20 percent from £4.99. If you want to go ad-free, it’s £12.99 after being increased by 18 percent from £10.99. The premium membership is now £18.99, up from £17.99 (six percent).

For those who have the additional members on their plans – something introduced when Netflix cracked down on its account sharing between households – it’ll go up form £4.99 to £5.99 for one extra member without ads. If you choose an extra member package with adverts it will be £4.99; up from £3.99.

Speaking about the price rise, Netflix said focus was on ‘reinvesting’ to ‘further improve’ the Netflix of the future.