After being founded in 2003, Tesla has gone on to become one of the most recognizable carmarkers of our time, and as of January 2025 has a market cap of $1 trillion, according to Companies Market Cap.

The company’s multiple electric car models, the divisive Cybertruck and its charging technologies have helped grow its worth, but it was actually the launch of one of its products that caused problems for Tesla beginning in 2017.

Tesla has a market cap of $1 trillion (Smith Collection/Gado/Getty Images)

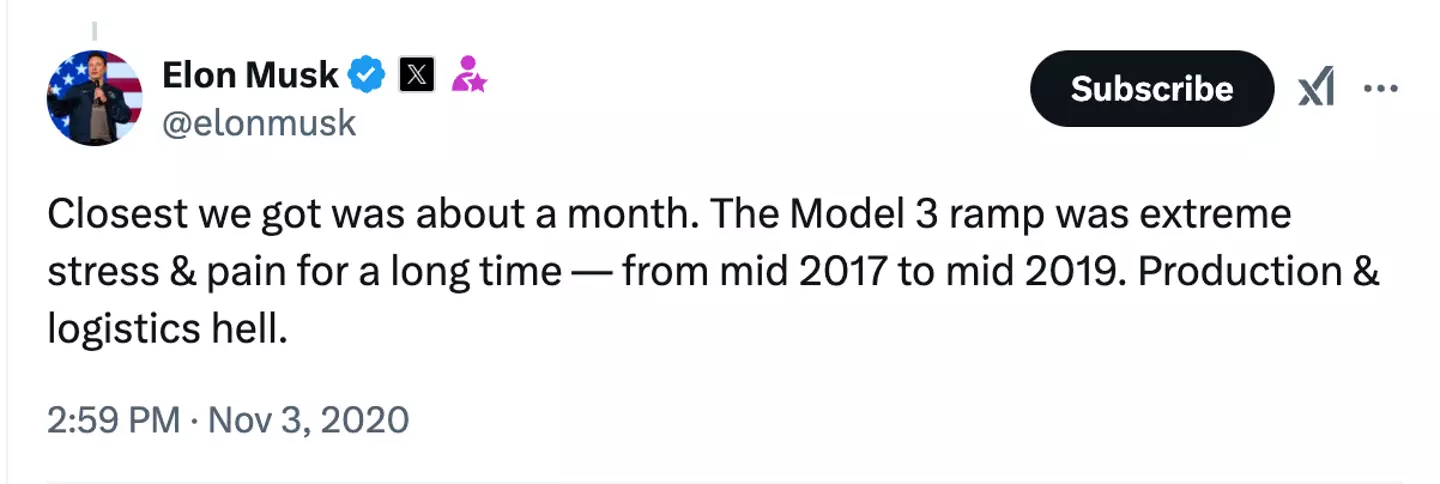

Musk admitted Tesla had been struggling in a post on Twitter in 2020, when he responded to an ‘On This Day’ post about some of Tesla’s earlier problems.

The post read: “On this day in 2008: Tesla secures $40 million loan to avoid bankruptcy. Today, it’s the most valuable automaker in the world.”

In response to the post, Musk revealed that Tesla had at one point been just one month away from complete bankruptcy.

The CEO revealed that the issues came as the company tried to figure out how to mass produce Tesla’s Model 3 electric car; a challenge that caused ‘extreme stress & pain for a long time – from mid 2017 to mid 2019’, according to Musk.

He added that the situation was ‘production & logistics hell’.

Musk spoke about Tesla’s money issues on Twitter (X/@elonmusk)

But in spite of the challenges the company faced, Tesla managed to make it through the tough period and come out the other side.

After struggling with the production of the model, Tesla went on to open a new factory in Shanghai with initial plans to produce 150,000 Model 3s per year, before increasing output to at least 250,000 vehicles a year.

The rise of Tesla didn’t necessarily mark the end of Musk’s dances with bankruptcy, though. In November 2022, the businessman was quoted as telling Twitter employees that ‘bankruptcy [wasn’t] out of the question’ after he purchased the social media platform one month earlier.

Addressing staff via email, he wrote: “Without significant subscription revenue, there is a good chance Twitter will not survive the upcoming economic downturn. We need roughly half of our revenue to be subscription.”